Source: Pixabay (Public domain)

Every year crooks around the world use different innovative techniques and bombard us with schemes to con you out of your money.

They are everywhere pulling off all kinds of scams -Nigerian scams, work-at-home scam, get-rich-quick in 30 days scam, an insurance scam, accident/injury scam, email scam, romantic scam, sex scam, etc.

These offenders are so smart, using some details they collect online, they are able to perform a vulnerability assessment by identifying and evaluating a weakness in a person relatively quickly and then decide to exploit it.

Fake prizes and lotteries, fake vacations, internet frauds, get rich quick schemes, cancer cures, and other miracle cures are all different ways conmen employ to scam you and take your money.

It is safe to assume that they have all the important information such as age, date of birth, full name, telephone number, and address before committing a crime. They may have information and facts nobody you know knows.

The objective of this article is to create awareness and for that, we need a better understanding of how these scams happen and what can be done to prevent such scams.

In this article

Identity Theft

But how do they get this information? It is mostly through identity theft. We don’t realize that we often unknowingly and involuntarily give away our personal information.

It can be easily collected from different forms you fill up online, a résumé you submitted to some organization, feedback you provided to a restaurant along with your name and phone number, details you posted on Twitter to outrage on the service provided by an airline, information available from your Facebook profile, through data centers of organizations that store information or through the telephone bill you trashed.

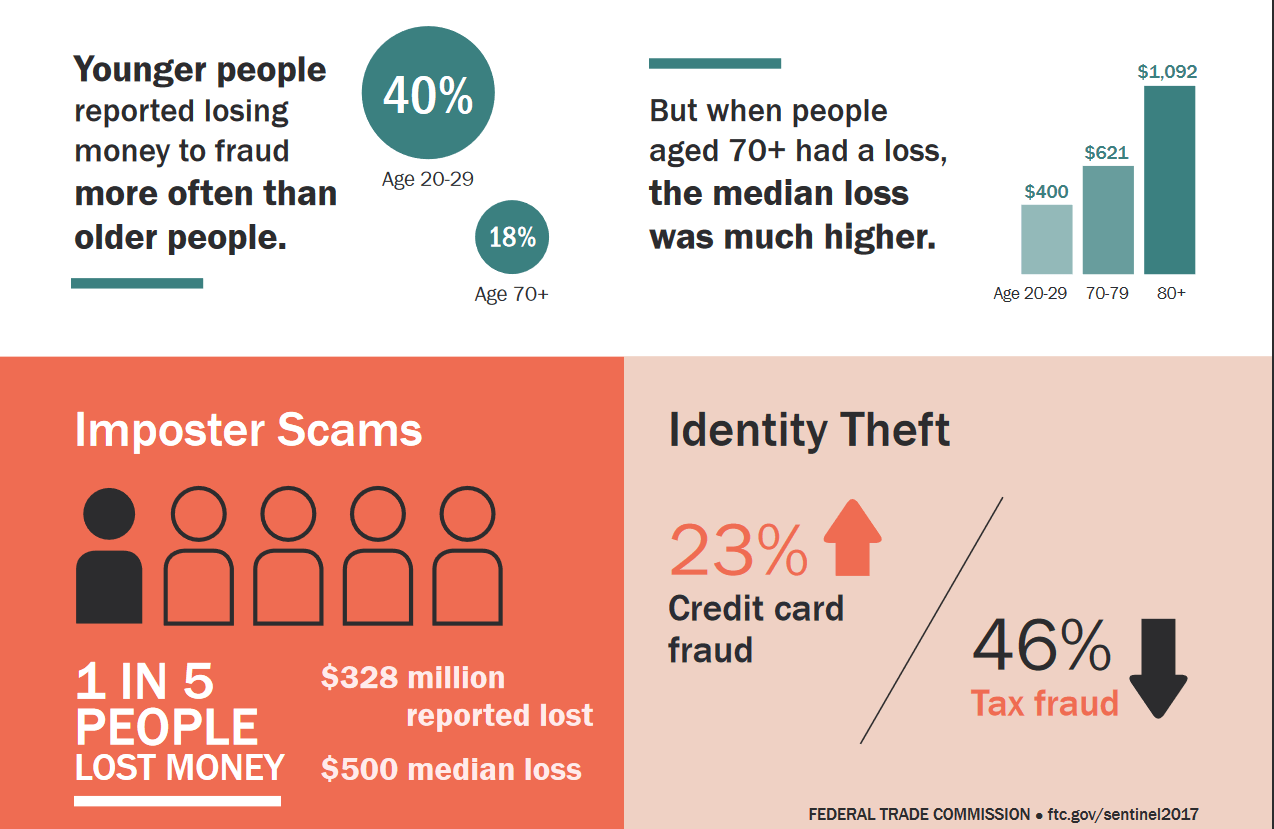

According to the Federal Trade Commission (FTC), interestingly millennials are more vulnerable to online scams than seniors. The research shows that “40 percent of adults age 20-29 who have reported fraud ended up losing money in a fraud case”.

Databases are a gold mine for conmen and they go to any lengths to access it sometimes even through Hitech monitoring technologies such as face recognition software.

Remember the strategy of a conman is to go after a hundred so that he finds at least a few. Black market sites also offer services that help these fraudsters receive information.

They often use a combination of old tricks with the latest technology to get people to send money or give out personal information. Billions of dollars are ripped off every year by criminals impersonating other people.

Gone are the days when people robbed banks using guns. Today they can do it through a telephone call or by skimming your credit card. All they need to do is just identify the weak points in the security infrastructure.

Most people believe they can never get scammed forgetting that all of us are vulnerable to a persuasive approach at some time or another. If they do get scammed they never report the crime as the shame of being scammed is harder to deal with. We are all emotionally vulnerable and have limitations and that is what makes scams work.

Research shows that online scams are very difficult to unearth as they are international often originating in a different country and law enforcement agencies simply don’t have resources to deal with it.

Impostor Scams.

Impostors often pretend to be someone you know and trust, like a government official, a tax officer, a family member, or a company you do business with.

Don’t send money or give out personal information in response to any unexpected request, no matter how urgent — as the idea is to stir up strong emotions, such as fear, and create pressure to make you pay them instantly.

Here are some warning signs to look out for-

Receiving a message through an unsolicited call or email claiming that you owe money to a business and may face arrest by authorities if you refuse to pay immediately. Someone who claims to be your grandchild or a close relation gives you a distress call and asks for funds for an emergency.

Work for us Scams, and Work from Home Scams

You may receive an email that looks like a real job offer.

This is not to say that genuine job offers don’t exist. But some job offers are for the purpose of money laundering.

The company may claim to be some kind of service provider that is currently facing some technical problems in receiving payments from their clients. They say they are looking for a partner/representative who can collect the payments on their behalf and earn some fee.

The job is simple—accept wire transfers, cheque payments, or cash and forward it back to them.

They promise to open an office soon in your country. The mail has a link to submit all your personal information such as name, bank details, and other particulars.

Sometimes money does get transferred but here is something you need to know. The money is coming from hijacked accounts and when you participate in the process of accepting and forwarding the same you are actually indulging in money laundering which is a serious crime.

Othe work at home jobs involves sending bulk mails, envelope stuffing, craftwork, or data entry. They lure you with catchy ads and big pay, but finally, pay very low or say your work is not up to the standard and don’t pay at all.

Don’t fall for phone scams

Don’t believe your caller ID. Go by your gut instincts. If something doesn’t sound right, or if it reeks of a scam, then it probably is. Nowadays with the help of technology, it is very easy for scammers to fake caller ID information. The number displayed isn’t always from the real caller.

If someone calls asking for money or personal information, hang up. If you receive a call from a hospital citing an emergency, saying someone you know is critical, and asking for money don’t panic and send the money. First, try to cross-check by calling the hospital.

Student Loan and debt relief scams

The modus operandi is simple; some bogus company may ask you to pay a hefty fee for their service to renegotiate the terms of the existing student loan or even waive off an existing loan.

If you pay, they will probably take the money and disappear. According to the FTC such scams have cost American borrowers more than $95 million in illegal upfront fees.

Never make an upfront payment or an advance to strangers, without checking them out. If you plan to make an investment do so through a registered broker.

Verify the license of every individual or firm/company you deal with and check their compliance history before entering into any financial transaction

Consider how you pay.

Credit cards have significant fraud protection built-in, but some payment methods don’t. Wiring money through services like Western Union or MoneyGram is risky because it’s nearly impossible to get your money back.

It is good to be suspicious about anyone who insists on only one form of payment.

Never pay to unfamiliar companies or rather any company without verifying them. Government offices and honest companies won’t require you to use these payment methods.

Before you give up your money or personal information, talk to someone you trust. Con artists want you to make decisions in a hurry.

Never pay upfront during the sales pitch. It is common for conmen to offer incentives for closing the deal. Wait for a few days, check the product/service properly, do an online search, consult an expert, be convinced, do some rational decision making, and then invest.

Avoid Robo-Calls and automated calls.

If you answer the phone and hear a recorded voice that says ‘congratulations, you won a free trip’ hang up. That is just the beginning of a trap.

They will next want you to either buy something or fill in some personal details. Just like how you install an anti-virus for your computer, install a robocall blocker app.

These calls are illegal in some countries, and often the products are fake. Don’t press on any number as that can be interpreted as consent and could lead to more calls. You can try the list of call-blocking resources from FCC

Tech Scams and Fraud

This is how the scam works. You get a call from someone who claims to be a computer tech support guy who tells you that your computer is infected with some viruses and needs to be cleaned up.

They promise to offer you online web support and ask you to first go to a specific website and follow the instructions. What happens behind the scenes is different. Malware and sometimes fake antivirus software is installed to steal your passwords and personal information.

Never accept any unsolicited tech support for your computer. Download an antivirus from the OEM (Original Equipment Manufacturer) website like Norton or Kaspersky.

Fake Check Scams.

In the US, as per law, banks must make funds from deposited checks available to the customer within days, but uncovering a fake check is a time-consuming process and can take weeks.

Here is one of the way’s how a fake check scam is carried out.

A person you don’t know, mostly someone who shows interest in doing some project or business or wants to buy a product you advertised online, offers to give you an advance payment through a check.

Then he says it’s kind of difficult to transfer you the money due to some outward remittance laws in their state and would prefer to pay someone, in the U.S. He will ask you to arrange for someone you know in the U.S. to receive the payment through a check.

He then asks the person you nominated to deposit the check— which is for several thousand dollars.

The amount is usually far more than you are owed. The reason for the excess payment given is —to send some of the money to another person who he says, is part of the project or business and needs to be paid urgently.

Scammers usually come up with good reasons for this arrangement. They might even say they paid excess “by mistake” and ask you to wire him the excess from your country.

Banks in the US provide the money immediately as they are required to do so within 15 days, sometimes even before the check is cleared.

Trusting the check to be genuine the person you nominated wires the money to the other person as instructed. The cheque deposited will turn out to be a fake and you will end up repaying the bank.

Pyramid schemes and multilevel marketing scams.

Pyramid schemes work by promising you big returns for a small investment.

They first make you pay a membership amount promising to make you part of a profitable venture.

That’s it, now the only way you can get back your investment is by working for them and getting more people to pay for such memberships.

If the company they want you to work for has bizarre products or is making any outrageous claims that don’t seem right, use caution.

Internet scams.

Don’t fall for the infamous 7 digit figure inheritance from an unknown friend in Africa.

Internet scams sometimes happen without you knowing it. There are many ways scammers use to cheat people online.

One way is to bombard you with unsolicited messages until you click on one of them. They are called spam. Spams are basically mass-email that are designed to sell products or collect personal information.

Sometimes they can send it cleverly stating it was mistakenly sent to you and it contains some ‘confidential information’ and was not intended for you to see, making you curious.

Sometimes merely clicking or unsubscribing is enough for them to penetrate your computer and access your files. Remember not to open any email that is not directly addressed to you but talks about some gains you can make or rewards you won.

Phishing Scam

Phishing is another way- they use it to pretend as a financial organization or any other company to get you to reveal your personal data.

Phishing works in interesting ways. For example, if you’ve recently placed an order online and are expecting a delivery, you may receive an email about a failed delivery attempt.

The email asks you to click on a certain link and update your details. The email could be a scam to collect your personal information. Always verify the email address properly and if necessary call the company you placed the order on to check.

Another way scammers access your personal details is by installing keyloggers, spyware, trojan horses, and other malicious software.

Most scams begin with a stolen purse or wallet. So carry it only when you really need to. Regularly monitor your accounts to see if there is any unusual activity. You can even have the credit monitor services to alert you of any activity. Shred any document that has sensitive information making it impossible to read before you trash it.

Smishing

Smishing is a form of phishing that is more common and is used to send out messages to customers luring them to share information by clicking on a malicious link or calling a number.

Be suspicious of messages that say “Hi—check out this cool link, or click to see your reward”. Remember they are after your money, so the best way you protect yourself is by doing nothing.

Duping Senior citizens

Evidence shows that old people are targeted to siphon off their savings as they trust people more and are more vulnerable.

They typically begin with someone telling them that they are working for some charitable organization and need to raise money for some social cause and in return would get gifts, tax exemptions, etc.

They show some brochures and other documentation to be convincing. People who end up paying never hear about them again and get nothing in return.

Online shopping fraud

Buying stuff online is convenient and usually safe. But with a growing number of online retailers, it is often difficult to ascertain which one is safe.

Fraud happens mostly by sellers posting an item online such as clothing, watches, or electronic items. People fall bait for the attractive price offered and get cheated.

The fraudulent seller takes your money in advance but never sends you the item you paid for because that was never the intention in the first place.

Such websites are created to cheat customers and collect the credit card details and other personal information so that they can use the information to buy merchandise elsewhere.

Travel and Vacation Fraud

The idea of going on a free vacation is exciting. But don’t fall for those hard to resist vacation deals or discounted tickets.

People often hurriedly submit personal information or pay up in advance for the trip or the ‘handling charges’ and ‘taxes’ fearing they may lose the offer.

It’s anyway ridiculous paying for a random prize or tickets they say you won. Always be skeptical of offers for “free” trips and if the trip is incredibly cheap, then look for hidden costs.

Dating scams

Millions of people turn to online dating apps or social networking sites to meet someone. According to the FTC in 2019, people reported losing $201 million to romance scams. People reportedly lost more money to dating/romance scams in the past two years than to any other fraud. Popularly known as catfishing, these dating scammers create fake online profiles that are appealing and designed to lure you on.

They establish contact with whom they consider easy targets using any of the popular social media sites like Instagram, Tinder, or Facebook.

The scammers are very good with words and emotions and strike up a relationship real fast and start sharing personal information.

They celebrate your birthday by sending flowers and gifts and drag on the relation for months and sometimes years to draw you in. They may recommend low-quality “spam” sites that they use to get your financial details.

Once the trust is established they may ask you to send pictures or videos of yourself, possibly of an intimate nature. They can ask you to share photographs and videos of friends also.

They usually ask for money by telling they need it for emergencies such as the operation of a parent or relative.

If you don’t give them the money asked, they resort to blackmailing by threatening to circulate the photographs and videos of yours and your friends on social media.

It is important to not agree to send money to anyone you haven’t met in person.

Don’t agree to send money to anyone else either as that is considered money-laundering and is a serious crime. Always consider the possibility of being scammed, no matter how sweet or how caring the person is.

Do an image search to determine their identity and make sure they are not impersonating somebody else. Use image search services such as Google or TinEye . Be extremely careful when sharing pictures and videos.

If you spot a scam, report it to the relevant authorities. Your reports help other law enforcement investigate scams and help prevent others from falling prey to these crooks.

Also read: Health Quackery: Spotting Health Scams

(The views expressed by the author in the article are his own)

Sign up for the QuackTrack.org newsletter below!